In fact the difference between an HMO and a PPO could be a couple of thousand dollars in premiums over the course of a year Giordano says. Difference Between HMO and PPO Definition of HMO.

What Is The Difference Between An Hmo And A Ppo

Learn more about Humanas dental HMO plan opens new window.

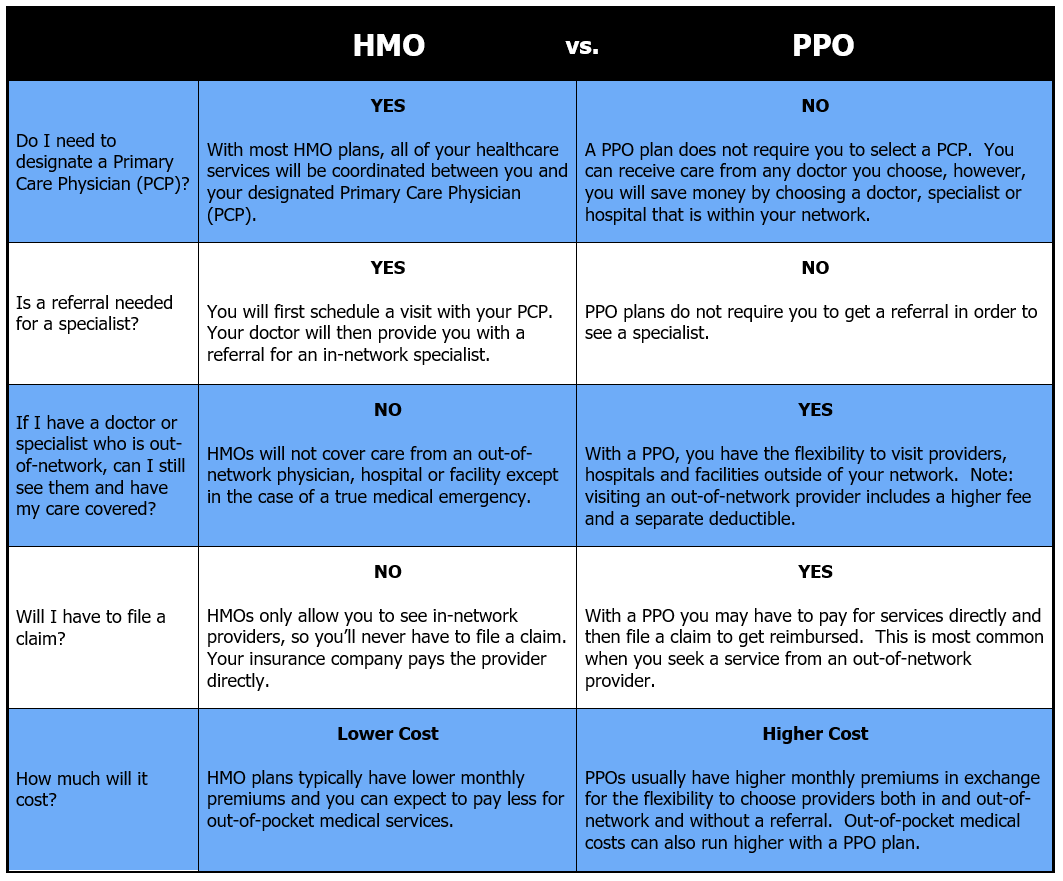

. Just like medical insurance dental insurance comes in HMO and PPO plans. A PPO gives you more freedom to. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization.

Like an HMO plan a PPO insurance plan provides a patient with a network referred to as a PPO network of health care providers and hospitals. Explain the difference between a HMO a PPO and a POS health insurance plan. While HMO and PPO plans are the 2 most common plans especially when it comes to employer-provided health insurance there are other plan types you should know about including EPO and POS plans.

Explain the difference between a HMO a PPO and a POS health insurance plan. You can get more information about the differences between HMOs and PPOs from our HMO vs. Health maintenance organization HMO Preferred provider organization PPO Point of service POS Exclusive provider organization EPO Before picking one compare how restrictive or flexible the networks they use are.

An HMO gives and individual access to particular hospitals and doctors within their network An. Each one is just a different balance point between benefits vs. When it comes to the selection of quality healthcare the tides always tend to.

The difference between HMO or Health Maintenance Organizations and PPO or Preferred Provider Organization is that unlike HMO under PPO the employees have the liberty to consult a doctor of their choice without the fear of footing the whole bill. If you dont like the doctors and hospitals in your PPO plans preferred. PPO comparison chart opens new window.

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. Restrictions and between spending a lot vs. If you are considering an HMO vs a PPO these are the main differences to keep in mind.

PPO HMO EPO exclusive provider organization and POS point of service plans have different benefits and costs. Medicare Advantage Health Maintenance Organization HMO Health Maintenance Organizations with Point of Service HMO POS and Preferred Provider Organization PPO plans are all network-based Medicare Advantage plans that is all three of these Medicare plans have a fixed network of hospitals doctors specialists and other health care providers that. Each network determines who you can get medical services from and how your medical claims work.

You can also expect to pay less out of pocket. The central differences in HMO vs PPO vs POS plans are. October 15 2021 in HomeAssignment Solution by.

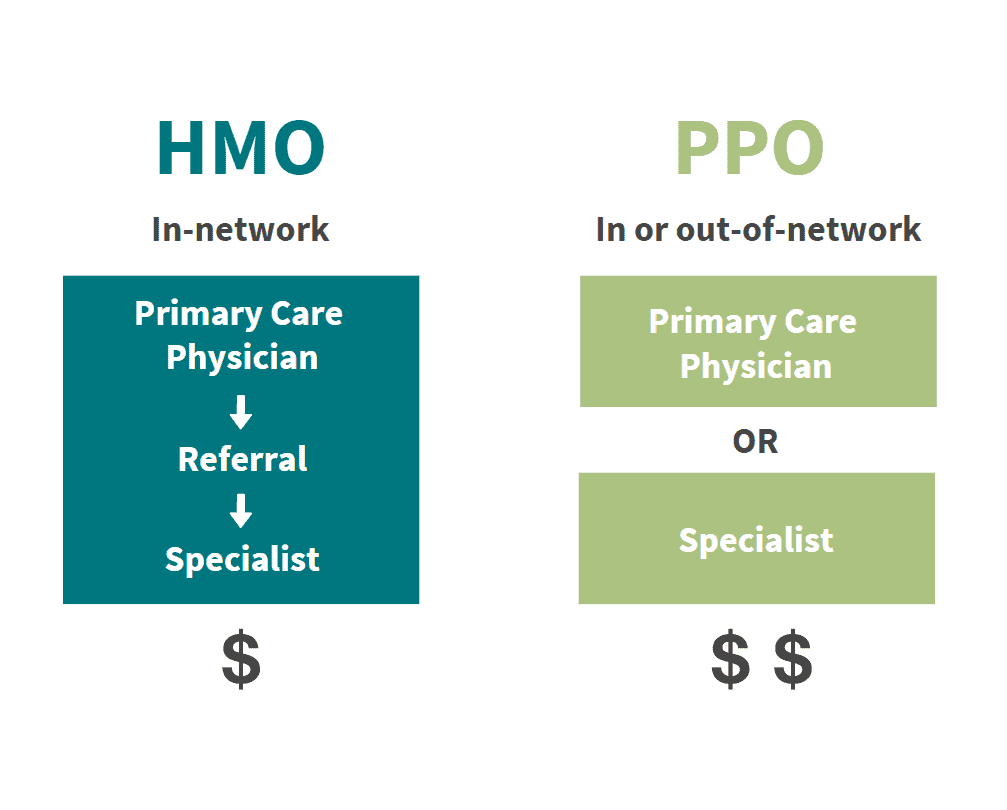

5 rows To start HMO stands for Health Maintenance Organization and the coverage restricts patients to. HMOs and POS plans require a primary care physician and referrals while PPO plans do not. A PPO is when you get to pick an chose your doctor and they help pay.

Now that you know a bit about choosing between PPO vs HMO healthcare it should be easier to understand which plan will work best for you. 5 rows HMO plans typically have lower monthly premiums. How much you have to pay if you see a provider who is out of network.

HMOs also typically have lower deductibles the amount you must pay before the insurance coverage kicks in than PPOs according to a 2011 analysis of health care plans by Consumer Reports. Cost On average HMO members can generally expect to pay lower premiums than members of PPO. In a PPO the insurers have struck a deal with some doctors but they arent actually part of the.

Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family. The differences besides acronyms are distinct. PPO plan is only covered if a doctor you chose is within the providers network.

They prefer you to choose from list of providers. What are the differences between HMO and PPO plans. PPO Vs HMO Find Your Best Fit.

Some of these plans provide more flexibility in which providers you can while see while others might require you to get permission or pre-authorization from the insurance company before you can have a medical procedure. If you travel outside your HMO plans service area frequently your health-care services other. So its cheaper but you can only see the doctors that are part of that HMO.

You must choose from list of providers. An HMO is like a medical subscription to a hospital system or dental network. Theres no perfect health plan type.

Still not sure an HMO is the way to go. Jones I will be more then happy to explain to you what is the difference between PPO plan and HMO plan and which one I would recommend but first let me explain what are the difference of an HMO plan. This plan also lets the patient coordinate their care and manage which providers they would like to see.

HMOs generally cost less. 5 rows HMO Versus PPO. Comparing an HMO vs PPO vs POS.

The first note is that it. Payment is higher if chosen from the list. It is a norm in the.

You have to see their doctors and follow their rules. However a PPO plan allows a patient to see whichever provider they choose even if they are out-of-network. Primary care physicians HMO plans generally require members to utilize a primary care physician PCP while PPO plans typically do not.

HMO and PPO are two famous managed health programs in the United States for employees. To kick off this comparison its essential to look at the meaning of HMO. As mentioned above Differences between HMO Health.

There are a few key differences between HMO and PPO plans. Whether or not you have to select a primary care physician who refers you to specialists. On the upside its usually easier for doctors and specialists to coordinate your health care because theyre all part of the same organization.

In an HMO the doctors and the insurers are all part of one company. In exchange for that added flexibility and decrease in negotiations for specialized care PPO plans require a higher monthly payment.

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

0 Comments